Another rate cut and a future outlook from the Fed

Another rate cut and a future outlook from the Fed

What can you expect next?

The Federal Reserve Board cut policy rates by 0.25% at their most recent meeting, as the markets expected. At his press conference, Fed Chair Jerome Powell said he expects additional "calibration" — or cuts — over time, though the timing is uncertain.

What exactly did the Fed say?

The Fed’s statement described solid economic growth and shrinking inflation but a cooling labor market. The statement reiterated that future action will be based on incoming data.

Will mortgage rates fall in response?

The Fed does not directly control mortgage rates. In fact, investors in mortgage-backed securities often act in anticipation of Fed moves. Rates had recently risen despite anticipation of a cut. It’s too early to know where they will settle after the Fed’s action.

Should you wait to make your move?Here are four factors to consider in your decision:

You may be able to land a better rate even before the Fed acts again. Mortgage rates often move in anticipation of Fed policy rate changes or in response to other news.

A Fed rate cut is likely to usher in more competition and higher house prices. Purchasing now at a slightly higher rate and lower price could be a less expensive option.

By purchasing now, you can divert your rent money to building equity in a home of your own. Paying rent builds equity for your landlord; making mortgage payments builds equity for you.

Getting started now with a pre-approval can put you at the starting line when you’re ready to make a move.

It's worth a chat.

We have calculators to help you weigh the potential costs when buying at a higher rate or a higher price.

We also have programs that can help mitigate higher rates. A hybrid ARM, for example, offers a lower initial rate before adjusting to fixed rates later. Fixed rate buydowns and HELOCs can help you move forward with your plans, too.

If you want to wait on your next purchase, this is a good time to prepare. A qualification consultation or even a pre-approval is a great place to start.

Background on the Fed:

The Federal Reserve Board (the Fed) controls the federal funds rate and discount rate, which are charges for overnight loans from bank to bank or from the Fed to member banks.

This rate was lowered to near zero in March 2020 in response to the pandemic.

The Fed has a standing inflation target of 2%. When historic inflation hit in March 2022, they began a cycle of rate increases to slow spending and bring it down.

September brought the first policy rate cut since the initial change in 2020. November's cut is the second of a predicted series of downward adjustments.

If this is your time to buy, refi or access cash from equity, don't let uncertainty about rates slow you down.

We're here to help, and we're closing loans every day!

WHAT OUR

CLIENTS ARE SAYING

Simone De Lira

Senior Loan Officer

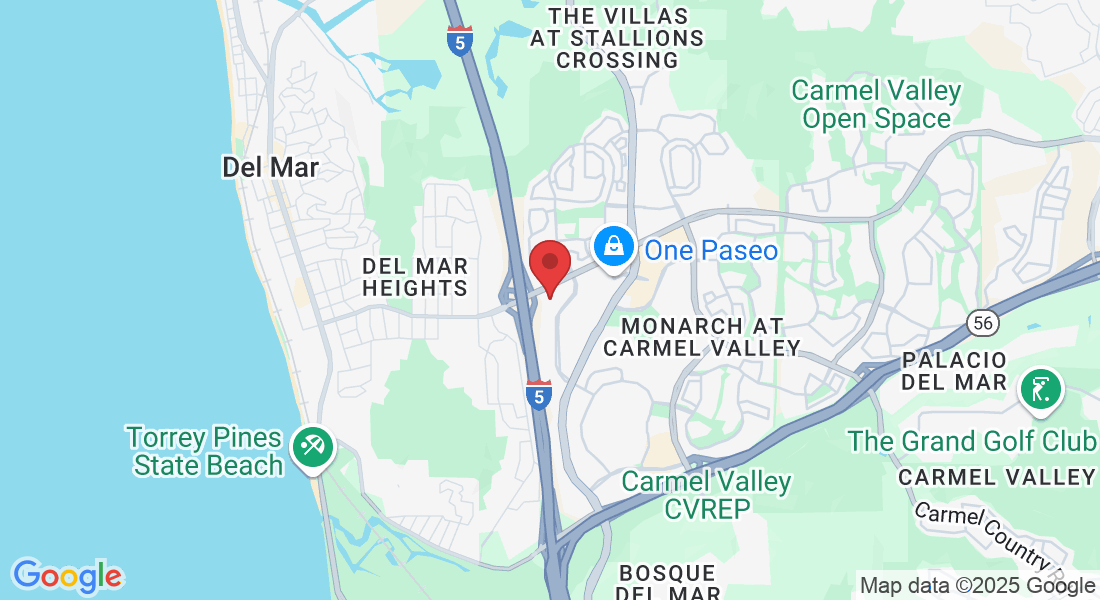

12750 High Bluff Drive Suite 300

San Diego, CA 92130

+1 (619) 804-7212